Despite a reputation as a technology laggard, as a whole, the insurance industry is making impressive advances in remaking processes and experiences for the digital world. Spurred on by digital-first disruptors, traditional carriers are investing heavily in digital transformation — from online shopping for policies to automated claims processing.

Despite a reputation as a technology laggard, as a whole, the insurance industry is making impressive advances in remaking processes and experiences for the digital world. Spurred on by digital-first disruptors, traditional carriers are investing heavily in digital transformation — from online shopping for policies to automated claims processing.

Yet many challenges remain for insurers:

- New entrants bring new experiences: New products and direct-to-consumer business models are forcing more traditional companies to rethink their approaches to the customer journey. They must deliver exceptional customer experiences to remain competitive.

- High consumer expectations: Today’s consumers are conditioned to receiving instant responses and frictionless experiences in their other interactions with businesses. They expect the same high level of service from their insurers.

- Attrition and employee dissatisfaction: Customer service jobs have never been more complex or challenging. Employees are increasingly stressed and disengaged, leading to poor experiences for both customers and service reps. As attrition rates go up, so do recruiting and training costs.

There is a way for insurers to harness digital transformation to address all of these challenges and more. By using conversational artificial intelligence (AI) and automation to transform contact center operations, they can achieve sustainable operational and customer experience improvements, gain a greater competitive edge, and produce a significant return on investment to help the bottom line.

An enhanced digital customer experience is a competitive must-have

According to a McKinsey study, more than 40% percent of insurtechs are focused on the marketing and distribution segments of the insurance value chain, enabling them to solve customer pain points through a digitally enhanced client experience that could pose a competitive threat to incumbents.

Customer service pain points plaguing the insurance industry

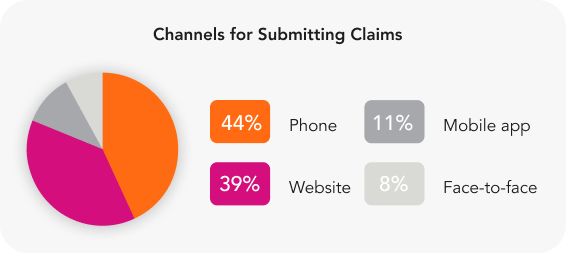

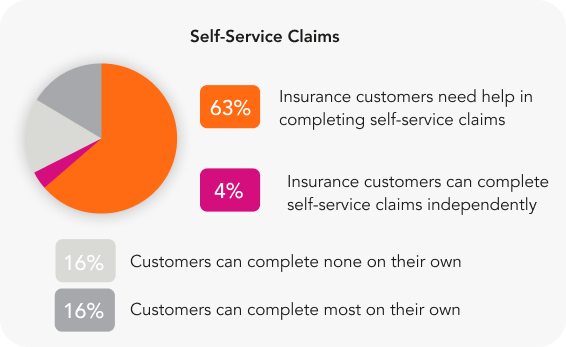

While the trend is clearly towards digital interactions throughout the customer journey, a survey of insurance professionals show that 44% of claims are still submitted by phone, with 39% submitted via website. And while insurers indicate that self-service is a top priority, only 4% of insurance professionals say that all customers can complete self-service claims independently. The majority (63%) say that customers need some help in completely self-service claims.

When self-service doesn’t fulfill customers’ needs, they have to pick up the phone and start over with an agent or customer service rep (CSR). This leads to customer dissatisfaction and higher churn, as well as frustrated employees and higher operational costs.

Within the contact center, the problems go beyond self-service failure rates. Today’s CSRs face high call volumes, complex and emotional customer issues, constant changes to terms and offerings, and a dizzying array of systems and knowledgebases to navigate to find answers. The daily stress of trying to meet performance expectations amid these challenges means more agents are disengaged and inclined to leave, driving hiring and training costs higher and customer satisfaction lower.

Finally, contact centers have been unsuccessful in turning all the unstructured data in conversations into valuable and actionable insights. Instead, they make decisions and provide feedback to CSRs based on limited information pulled from a tiny subset of interactions, leading to missed opportunities, misleading data on trends, and insufficient feedback on performance.

A Multichannel Strategy Improves Satisfaction

According to the J.D. Power 2022 U.S. Auto Insurance Study, when customers engage with their insurer via both digital channels and live channels — such as agents or customer service representatives (CSRs) — satisfaction with the live channel increases. The reason is efficiency, as customers can handle transactions quickly while spending more valuable time with an agent or CSR. A multi-channel strategy is a successful approach, and the same is true when live channels are added for customers who primarily take a digital-first approach.

Why it’s time to embrace conversational AI in the contact center

The insurance industry is turning to AI as a transformative technology to reduce risk, improve operational efficiency, understand customer behavior and needs, as well as many more use cases. From claims processing to distribution, underwriting, pricing and fraud detection, AI is fast becoming table stakes to compete with insurtech upstarts.

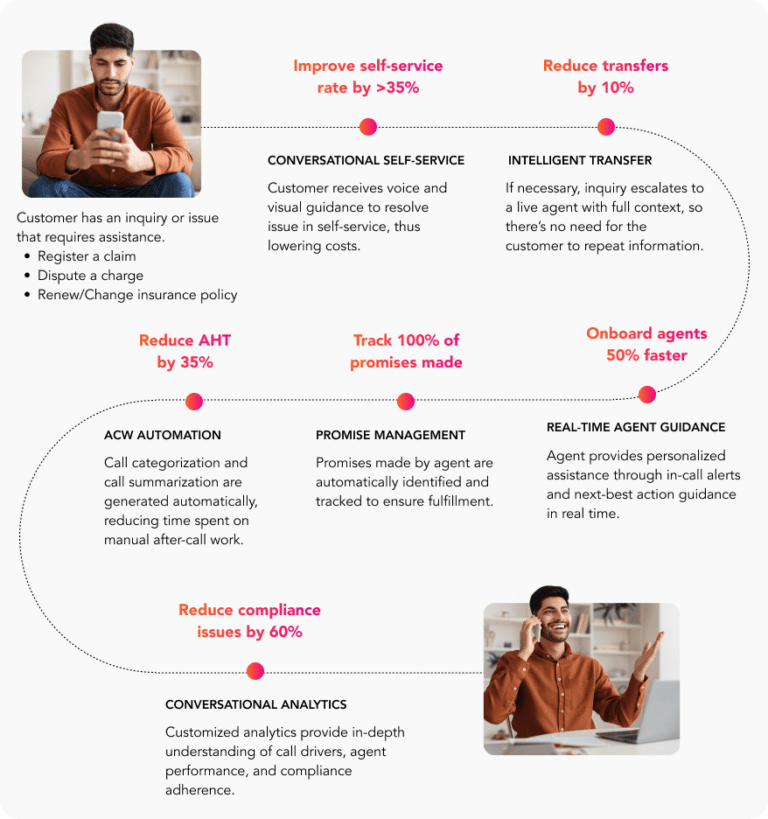

Now insurers are discovering that domain-specific conversational AI can be a game changer in the contact center as well. With a sophisticated conversational AI and automation platform, insurers can automate end-to-end customer journeys, guide CSRs to help them resolve issues faster and deliver a better customer experience, and uncover hidden insights and opportunities for operational improvements.

| PAIN POINT | SOLUTION | BENEFITS |

|---|---|---|

| Low self-service completion rates | A multimodal AI intelligent virtual assistant (IVA) across IVR, web, and mobile as a voicebot and/or chatbot for an intuitive, convenient self-service experience for customers |

|

| Poor CSR and customer experiences | Real-time in-call agent assistance |

|

| Time-consuming and error-prone manual tasks | After call work (ACW) automation |

|

| Limited, subjective insight into patterns, trends and performance | Interaction analytics on 100% of calls and automated compliance management |

|

Impact Every Point in the Customer Service Journey

A Multichannel Strategy Improves Satisfaction

According to McKinsey, the insurance industry is “… on the verge of a seismic, tech-driven shift. AI implementations could increase productivity in insurance processes and reduce operational expenses by up to 40% by 2030.”

Conclusion

For today’s insurance company, whether traditional or new entrant, transforming the contact center with conversational AI and automation must be a top priority now — not three-to-five years or longer down the road. The technology is mature and the window of opportunity to get out in front of competitors will close quickly.

Starting now with a proven solution that can demonstrate value quickly will be the insurance businesses in this industry need to thrive in the future.